Credit Precisor software enables a fully audited and efficient process for risk-based loan pricing and calculation of borrower’s credit creditworthiness (rating/scoring grade and corresponding PD as well as LGD with collateral evaluation).

The risk-based loan pricing is accurately calculated based on the credit risk costs (PD, LGD, EAD, capital), cost of funding, operating and administrative costs, interest rates and detailed transaction characteristics as well as any adjustment to market condition and competition (contact AnalytiX Boutique for a demo and commercial details).

Precisor Risk-Based Loan Pricing software is built to comply with regulations such as EBA’s GUIDELINES ON LOAN ORIGINATION AND MONITORING and similar regulations in other jurisdictions.

The main risk-based loan pricing features provided by Precisor Risk-Based Loan Pricing software are:

- Accurate risk-based loan risk-based pricing and IFRS9 considerations

- Environmental and Social Governance (ESG) evaluation

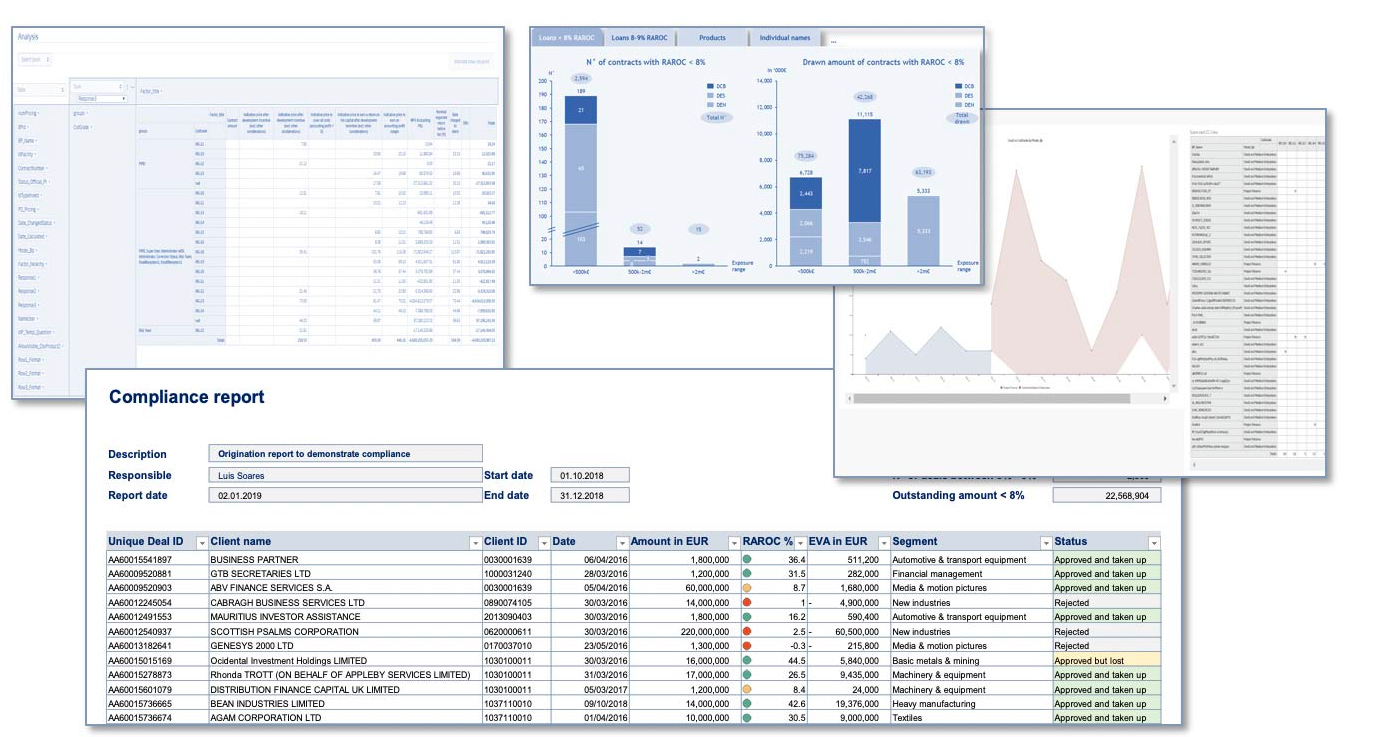

- Transaction and client relationship profitability analysis (EVA, RAROC, RORWA, RORAC, ROTA and others)

- Ex-post profitability analysis of the loan portfolio

- Assessment of borrower’s creditworthiness (Rating/scoring)

- Loan creditworthiness scenario analysis engine

- Cost allocation engine

- Monitoring

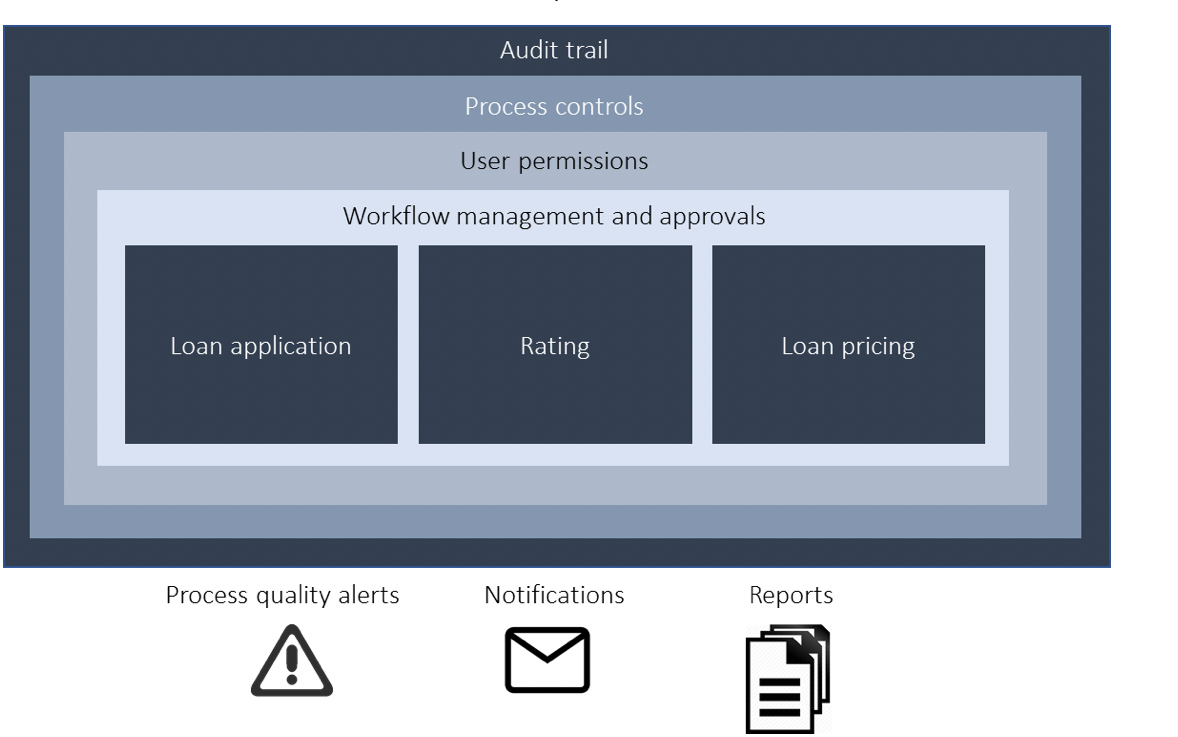

- Internal governance for credit granting

Download Precisor Risk-Based Loan Pricing application brochure.